How To Export Apple Card Transactions To A Spreadsheet

How to export Apple Card transactions to a spreadsheet is a question many Apple Card users ask. Being able to track your spending and analyze your financial habits is important, and Apple Card makes it easy to export your transaction history into a spreadsheet.

You can then use this data for budgeting, analyzing spending patterns, or even just for record-keeping purposes.

There are several ways to export your Apple Card transactions, including using the Apple Wallet app, the Apple Card website, or even third-party apps. Each method has its own pros and cons, so it’s important to choose the method that best suits your needs.

In this guide, we’ll walk you through the steps involved in exporting your Apple Card transactions, as well as discuss the different methods available.

Understanding Apple Card Transactions

Your Apple Card statement provides a detailed record of all your spending and account activity. It’s a valuable tool for tracking your finances and ensuring everything is accurate.

Transaction Details

Each transaction entry on your Apple Card statement includes several pieces of information to help you understand your spending.

- Date:The date the transaction occurred.

- Merchant:The name of the business where you made the purchase.

- Amount:The amount of money spent on the transaction.

- Category:A broad category that helps you classify the type of purchase, such as “Dining,” “Shopping,” or “Travel.”

Common Transaction Types

Here are some common types of transactions you might see on your Apple Card statement:

- Purchases:These are the most common type of transaction and represent the money you spend using your Apple Card at various merchants.

- Payments:This is the money you use to pay down your Apple Card balance. It can be a scheduled automatic payment or a manual payment you make through the Apple Wallet app.

- Fees:Fees associated with your Apple Card, such as late payment fees or over-limit fees.

- Credits:These are refunds or adjustments to your account, such as a return or a price adjustment.

Accessing Apple Card Transaction History

To access your Apple Card transaction history, you’ll need to use the Apple Wallet app on your iPhone or iPad. This app provides a comprehensive view of your spending activity, allowing you to track your purchases, monitor your balance, and manage your card.

Viewing Transaction History

The Apple Wallet app allows you to view your transaction history in a user-friendly way. You can see all your transactions listed chronologically, with details such as the date, amount, merchant, and location. This comprehensive view helps you stay organized and track your spending habits.

Viewing Transactions on a Specific Date Range

To view transactions within a specific date range, you can use the built-in filters in the Apple Wallet app. Simply tap on the “Filter” button and select the desired date range. This feature allows you to narrow down your transaction history and focus on specific periods, making it easier to analyze your spending patterns.

Exporting your Apple Card transactions to a spreadsheet can be a lifesaver when you need to track your spending or reconcile your budget. If you’ve ever lost a QuickTime file before you could save it, though, you’ll be happy to know that you can actually recover it using a handy trick, like the one described in this article: Recover unsaved QuickTime files with this handy trick.

Once you’ve got your Apple Card transactions in a spreadsheet, you can start sorting and analyzing your spending habits, which can help you make smarter financial decisions.

Viewing Transactions by Merchant

The Apple Wallet app allows you to easily view transactions by merchant. To do this, simply tap on the “Merchant” button and select the desired merchant from the list. This feature is particularly useful when you want to track your spending at specific stores or businesses.

Filtering Transactions by Category or Type

The Apple Wallet app also allows you to filter transactions by category or type. You can categorize your transactions by spending category, such as “Dining,” “Shopping,” or “Entertainment.” This feature helps you understand your spending habits and identify areas where you might be overspending.

Exporting Transactions to a Spreadsheet

Once you’ve gathered your transaction history, you can export it to a spreadsheet for easier analysis and management. Apple Card offers a couple of ways to do this, each with its own advantages and drawbacks. Let’s explore these options.

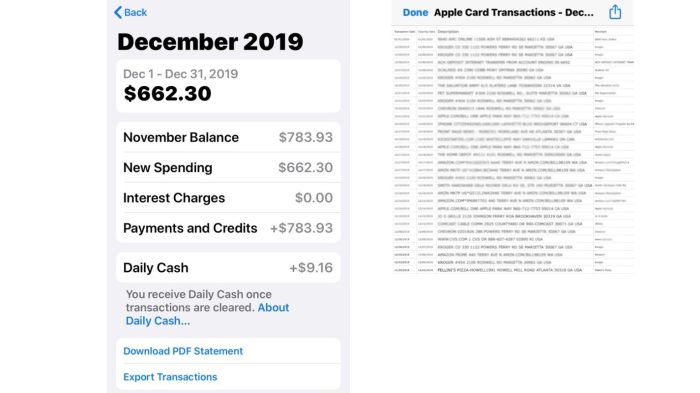

Exporting Transactions from the Apple Wallet App

This method is the most straightforward, allowing you to quickly export a snapshot of your transaction history.

You can export your Apple Card transaction history from the Apple Wallet app.

Figuring out how to export Apple Card transactions to a spreadsheet can be a bit of a pain, but it’s totally doable. You might need to check out some resources online, but once you’ve got your data, you can analyze your spending like a pro.

Speaking of pro, you know you can connect your AirPods Max to non-Apple devices, right? It’s super easy! Just check out How to connect AirPods Max to non-Apple devices for a quick guide. Anyway, back to the Apple Card transactions – once you’ve got them exported, you can track your spending, create budgets, and even see if you’re eligible for some sweet cash back rewards.

Here’s how:

- Open the Apple Wallet app on your iPhone.

- Tap on your Apple Card.

- Tap on the “Activity” tab.

- Tap on the “Export” button in the top right corner.

- Choose the date range for the transactions you want to export.

- Tap on “Export” again to confirm.

- Your transactions will be exported as a CSV file, which you can open in a spreadsheet program like Microsoft Excel or Google Sheets.

- Pros:Easy to use, quick export process, works directly from the Apple Wallet app.

- Cons:Limited customization options, only exports a snapshot of transactions from the selected date range, does not include detailed transaction information like merchant category or transaction type.

Exporting Transactions from the Apple Card Website, How to export Apple Card transactions to a spreadsheet

The Apple Card website provides a more comprehensive option for exporting your transaction history. This method allows you to download your entire transaction history, including detailed information about each transaction.

You can download your Apple Card transaction history from the Apple Card website.

Here’s how:

- Visit the Apple Card website.

- Log in to your account.

- Go to the “Activity” tab.

- Click on the “Export” button.

- Select the date range for the transactions you want to export.

- Click on “Export” again to confirm.

- Your transactions will be exported as a CSV file, which you can open in a spreadsheet program like Microsoft Excel or Google Sheets.

- Pros:Provides detailed transaction information, allows you to export your entire transaction history, offers more customization options for the exported data.

- Cons:Requires accessing the Apple Card website, may be slower than exporting from the Apple Wallet app.

Exporting Options

If you prefer a more traditional approach to managing your finances, you can also export your Apple Card transactions directly from the Apple Card website. This method offers a different set of data fields and file formats compared to the app, so it’s helpful to understand the nuances before you choose this option.

Data Fields and File Format

The Apple Card website provides a slightly different set of data fields when exporting transactions compared to the app. Here’s a breakdown of the key differences:

- Transaction Date:The website provides the date of the transaction in a standard format (MM/DD/YYYY), similar to the app.

- Transaction Description:The website displays the transaction description, similar to the app, but it may be slightly different in formatting or detail. For example, a transaction description from a merchant may be shortened or abbreviated on the website.

- Transaction Amount:The website shows the transaction amount in dollars, similar to the app, but may not include the breakdown of the Apple Cash back earned for that transaction.

- Transaction Category:The website offers a selection of transaction categories, such as “Food,” “Shopping,” or “Travel,” allowing you to categorize transactions for better budgeting. The categories may differ slightly from the app’s options.

- Merchant Name:The website displays the merchant name, similar to the app, but may be presented in a different format. For example, the website may use the merchant’s legal name instead of the name commonly used on the transaction receipt.

- Transaction Location:The website may not include the transaction location information, unlike the app. This can be helpful for tracking spending habits based on location.

The Apple Card website exports transactions in a standard CSV (Comma Separated Values) file format. This is a widely supported format that can be opened and edited in most spreadsheet applications, such as Microsoft Excel or Google Sheets.

Limitations and Restrictions

While the Apple Card website provides a convenient way to export transactions, there are some limitations to keep in mind:

- Limited Data Fields:The website’s export functionality may not include all the data fields available in the app, such as the Apple Cash back earned for each transaction. This can be a drawback if you’re looking for a detailed analysis of your spending and rewards.

- No Transaction Notes:The website doesn’t allow you to add notes to your transactions, which can be useful for tracking specific details about a purchase. If you rely on notes for additional context, you’ll need to add them manually after exporting the transactions.

- Limited Export Period:The website may limit the export period to a specific timeframe, such as the last 90 days or the current billing cycle. If you need to access transactions from a longer period, you may need to use the app’s export feature.

Utilizing Exported Transactions

Once you’ve exported your Apple Card transactions to a spreadsheet, you can use this data for a variety of purposes, such as budgeting, financial analysis, and tracking spending habits. This information allows you to gain a deeper understanding of your financial behavior and make informed decisions about your finances.

Categorizing and Analyzing Transactions

Categorizing your transactions helps you understand where your money is going and allows you to identify areas where you might be overspending. You can create a new column in your spreadsheet to assign categories to each transaction. For example, you could categorize transactions as “Groceries,” “Dining,” “Entertainment,” “Transportation,” “Bills,” or “Savings.”

You can manually categorize each transaction, or you can use a spreadsheet function like “VLOOKUP” to automatically categorize transactions based on a predefined list.

Using Spreadsheet Formulas for Financial Analysis

Spreadsheets offer powerful formulas and functions that you can use to analyze your transaction data. Here are a few examples:

Calculating Expenses

You can use the “SUMIF” function to calculate the total amount spent in a specific category. For example, the formula “=SUMIF(Category Column, “Groceries”, Amount Column)” would calculate the total amount spent on groceries.

Calculating Income

If you have income transactions included in your export, you can use the “SUMIF” function to calculate total income. For example, the formula “=SUMIF(Transaction Type Column, “Income”, Amount Column)” would calculate the total income.

Figuring out how to export your Apple Card transactions to a spreadsheet can be a bit of a pain, but it’s totally doable. You can use the Apple Wallet app, or if you’re feeling overwhelmed by notifications, maybe take a break and check out How to stop the Mail app from randomly interrupting you in macOS to help manage your workflow.

Once you’re back on track, you’ll be able to easily track your spending and budget with a spreadsheet of your Apple Card transactions.

Calculating Net Balance

To calculate your net balance (income minus expenses), you can use the “SUM” function to calculate the total income and expenses and then subtract the expenses from the income. For example, the formula “=SUM(Income Column)

SUM(Expense Column)” would calculate the net balance.

Data Security and Privacy

Exporting your Apple Card transactions to a spreadsheet can be a valuable tool for budgeting, tracking spending, and analyzing your financial habits. However, it’s crucial to be mindful of the security and privacy of your sensitive financial data. Your financial data is highly sensitive, and it’s essential to take precautions to prevent unauthorized access and misuse.

Safeguarding Your Data

It’s important to understand how Apple safeguards your data and the steps you can take to further protect your exported transactions.

- Apple’s Data Security Practices:Apple employs robust security measures to protect your data, including encryption, access controls, and regular security audits. They prioritize user privacy and adhere to industry best practices for data protection.

- Protecting Exported Transactions:Once you’ve exported your transactions, it’s your responsibility to secure the data. Consider using a password-protected spreadsheet, storing the file in a secure location, and limiting access to authorized individuals.

- Data Disposal:When you no longer need the exported data, it’s crucial to dispose of it securely. This could involve deleting the file, overwriting it with random data, or physically destroying the storage medium.

Tips for Securing Exported Transaction Data

Here are some additional tips for protecting your exported Apple Card transactions:

- Use Strong Passwords:If you’re using a password-protected spreadsheet, ensure you use a strong password that includes a combination of uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessable passwords like your birthday or pet’s name.

- Enable Two-Factor Authentication:If you’re storing the spreadsheet on a cloud service, enable two-factor authentication for an extra layer of security. This requires you to enter a code sent to your phone or email in addition to your password when logging in.

- Be Cautious of Phishing Scams:Be wary of emails or messages asking for your Apple Card information or requesting you to download a file containing your transactions. These could be phishing attempts designed to steal your data.

Troubleshooting Export Issues: How To Export Apple Card Transactions To A Spreadsheet

While exporting Apple Card transactions is generally straightforward, you might encounter some hiccups along the way. This section covers common issues and provides troubleshooting steps to help you get your transaction data smoothly.

File Format Issues

Exporting your transactions in a specific file format, like CSV, can be useful for analysis. However, you might face problems with the file format itself. For instance, you may encounter difficulties opening the exported file in your preferred spreadsheet software.

This could be due to the file being corrupted or the software not recognizing the specific file format.

- Verify File Extension:Double-check the file extension. Make sure it’s the correct format you intend to use (e.g., .csv, .xls, .xlsx).

- Use a Different Spreadsheet Software:If your current spreadsheet software isn’t working, try opening the exported file in a different program like Microsoft Excel, Google Sheets, or Apple Numbers.

- Open with Text Editor:If you’re unsure about the file format, open it with a text editor (like Notepad or TextEdit). This will show you the raw data and might help identify any formatting errors.

- Re-export:If you suspect a corrupted file, try re-exporting your transactions.

Data Access Errors

Occasionally, you might encounter errors related to accessing your transaction data. This could be due to temporary glitches in the Apple Card app, network connectivity issues, or even Apple Card server outages.

- Check Internet Connection:Ensure you have a stable internet connection.

- Restart Apple Card App:Close and reopen the Apple Card app. This can often resolve temporary glitches.

- Restart Your Device:Restarting your iPhone or iPad can also help address potential app issues.

- Contact Apple Support:If the issue persists, contact Apple Support for assistance.

App Compatibility

While the Apple Card app generally works well with various devices and software, compatibility issues can sometimes arise. This might prevent you from successfully exporting your transactions.

- Update Apple Card App:Ensure you’re using the latest version of the Apple Card app. Updates often address compatibility issues and bug fixes.

- Update Operating System:Make sure your iPhone or iPad is running the latest iOS or iPadOS.

- Check Device Compatibility:Ensure your device meets the minimum system requirements for the Apple Card app.

Conclusive Thoughts

Whether you’re a seasoned financial whiz or just starting to get your finances in order, exporting your Apple Card transactions to a spreadsheet is a valuable tool. By taking control of your financial data, you can gain valuable insights into your spending habits and make informed decisions about your money.

So, grab your spreadsheet software and get ready to unlock the power of your Apple Card transactions!

Expert Answers

What file formats can I export my Apple Card transactions in?

You can typically export your Apple Card transactions in a CSV (Comma Separated Values) file format, which is compatible with most spreadsheet programs like Microsoft Excel, Google Sheets, and Apple Numbers.

Can I export only a specific date range of transactions?

Yes, most methods allow you to specify a date range for the transactions you want to export. This helps you focus on specific periods for analysis.

Are there any limitations on the number of transactions I can export?

While there are no strict limits on the number of transactions you can export, there might be practical limitations depending on the method you choose. For example, exporting a large number of transactions from the Apple Card website might take longer to process.

How secure is exporting my Apple Card transaction data?

Apple prioritizes data security and uses encryption to protect your financial information. However, it’s always a good idea to be mindful of data security best practices, such as storing your exported files in a secure location and using strong passwords.