How To Clear Credit Card Info From A Stolen Apple Watch

How to clear credit card info from a stolen Apple Watch is a question that’s likely crossed your mind if you’ve ever lost your smartwatch. It’s not just about losing a fancy gadget; it’s about protecting your financial information.

If your Apple Watch is stolen, the thief could potentially access your credit card details stored within Apple Pay, leaving you vulnerable to unauthorized purchases. This guide will walk you through the steps to secure your financial information and minimize the damage if your Apple Watch falls into the wrong hands.

First, it’s important to understand that Apple Pay is designed with security in mind. It uses a unique token system to represent your credit card information, so the actual card details aren’t stored on your Apple Watch. However, if the thief has access to your Apple Watch, they can still make contactless payments using Apple Pay, even if they don’t have your PIN.

This is why it’s crucial to act quickly and disable Apple Pay as soon as you realize your watch is gone.

Understanding the Threat

Losing your Apple Watch can be a major inconvenience, but it can also be a security nightmare if you store sensitive information like credit card details on it. The potential risks of having your credit card information stored on a stolen Apple Watch are significant, and understanding these risks is crucial for protecting your financial well-being.

Methods of Compromise

The ways in which credit card information can be compromised on a stolen Apple Watch vary depending on how the information is stored. If you’ve added your credit card to Apple Pay, the risk is relatively low because the actual card details aren’t stored on the watch itself.

However, there are still potential vulnerabilities.

- Stored Card Information:If you have manually entered your credit card details into an app on your Apple Watch, such as a shopping or food delivery app, the information could be accessed by the thief.

- Apple Pay:Even though Apple Pay doesn’t store your credit card details on the watch, the thief could potentially use your watch to make contactless payments using your Apple Pay account if they know your passcode.

- Data Recovery:If the thief has access to your Apple Watch’s data, they could potentially retrieve your credit card information from the device’s memory or backups.

Potential Scenarios

Imagine a thief finds your lost Apple Watch and, after a few attempts, unlocks it. They could then use it to make purchases at stores or online using Apple Pay. Alternatively, they could access your credit card information from apps that store it directly on the device.

It’s important to note that the thief doesn’t need to physically access your watch to potentially misuse your credit card information. They could potentially use your stolen watch to make fraudulent transactions remotely, especially if they have access to your Apple ID credentials.

Immediate Actions Upon Theft

The moment you realize your Apple Watch is missing, a swift and decisive response is crucial to minimizing potential damage. This involves a series of immediate actions to safeguard your personal information and prevent unauthorized access to your accounts.

Reporting the Theft

Reporting the theft to the appropriate authorities is paramount. This not only helps recover your watch but also serves as a record of the incident for potential insurance claims. Here’s a step-by-step guide to reporting the theft:

- Contact Your Local Police Department:File a police report detailing the theft, including the date, time, and location of the incident. This report will be essential for insurance purposes and may assist in the recovery of your watch.

- Report to Apple:Contact Apple Support and report the loss or theft of your Apple Watch. This step is crucial for disabling Apple Pay and other sensitive features on the device.

- Notify Your Financial Institutions:Contact your bank or credit card company to report the loss of your Apple Watch and any potential unauthorized transactions. This helps prevent fraudulent activity and protects your finances.

Disabling Apple Pay and Other Features

To prevent unauthorized use of your Apple Watch, it’s critical to disable Apple Pay and other sensitive features.

- Use Find My iPhone:If you have an iPhone, use the Find My iPhone app to locate your Apple Watch and remotely erase its data. This will remove all your personal information from the device.

- Disable Apple Pay:If your Apple Watch is lost or stolen, you can disable Apple Pay by going to your iPhone’s Wallet app. This will prevent any further transactions from being made using your watch.

- Deactivate Other Features:Depending on your Apple Watch model and setup, you may have other features like access to your health data or other apps. Consider deactivating these features as well to minimize potential security risks.

Contacting Apple Support

After taking immediate action to secure your Apple Watch, it’s crucial to contact Apple Support for further assistance in clearing your credit card information. They can help you remotely remove your payment details from your device and prevent unauthorized purchases.

If your Apple Watch gets swiped, you’ll want to clear your credit card info ASAP. First, you can disable Apple Pay on your iPhone, and then you can use the “Find My” app to locate your watch. You can also use the iPhone camera’s built-in manual controls, like the exposure settings , to take a clear picture of the thief if they’re still nearby.

Once you’ve secured your watch, you can contact your bank to report the theft and cancel your credit card.

Steps to Contact Apple Support, How to clear credit card info from a stolen Apple Watch

Contacting Apple Support is straightforward. Here’s a step-by-step guide to get the help you need:

- Visit Apple’s Support Website:Go to Apple’s official support website (support.apple.com).

- Select “Apple Watch” from the list of products:This will direct you to a page with specific support options for Apple Watches.

- Choose “Contact Us” or “Get Support” option:This will usually present you with a list of ways to contact Apple Support, such as phone, chat, or email.

- Select the method that suits you best:Depending on your preference and urgency, you can choose to call Apple Support, start a live chat session, or send an email.

- Follow the prompts and provide necessary information:Be prepared to provide your Apple ID, device serial number, and a brief description of the issue.

Effective Communication with Apple Support

To ensure a smooth and efficient interaction with Apple Support, follow these tips:

- Be clear and concise:Explain the situation clearly and concisely, emphasizing that your Apple Watch has been stolen and you want to remove your credit card information.

- Provide all relevant details:Be ready to provide your Apple ID, device serial number, and any other information they may request.

- Be patient and polite:Apple Support agents are there to help, so remain patient and courteous throughout the conversation.

Information to Provide to Apple Support

When contacting Apple Support, ensure you have the following information ready:

- Your Apple ID:This is your primary account for all Apple devices and services.

- Your Apple Watch serial number:This unique identifier can be found on the back of your Apple Watch or in the Apple Watch app on your iPhone.

- The date and time of the theft:This information helps Apple Support pinpoint the timeline of the incident.

- Details of the credit card you want to remove:Provide the name on the card, card number, and expiration date.

Credit Card Company Reporting

Reporting the theft of your credit card information to your credit card company is crucial to mitigating potential financial damage. Prompt action can help prevent unauthorized transactions and protect your credit score.

Reporting Stolen Credit Card Information

Immediately contacting your credit card company is the first step in safeguarding your finances. They can freeze your account, preventing further fraudulent charges. The process typically involves:

- Calling the customer service number on the back of your card.

- Providing your account details and explaining the situation.

- Filing a formal dispute or fraud report.

Importance of Immediate Reporting

Delayed reporting can have significant consequences. Here are some key points to consider:

- Increased Liability:Credit card companies generally have a grace period for reporting fraudulent activity. If you wait too long, you might be held responsible for unauthorized charges exceeding the grace period.

- Credit Score Impact:Unreported fraudulent activity can negatively impact your credit score, making it harder to secure loans or credit in the future.

- Difficulty in Recovering Funds:Waiting to report can make it more challenging to recover stolen funds, as the credit card company may have a more difficult time tracking down the fraudulent transactions.

Contact Information for Major Credit Card Companies

Here’s a table outlining the contact information for major credit card companies:

| Credit Card Company | Phone Number | Website |

|---|---|---|

| Visa | 1-800-847-2911 | visa.com |

| Mastercard | 1-800-627-8372 | mastercard.com |

| American Express | 1-800-528-4800 | americanexpress.com |

| Discover | 1-800-347-2683 | discover.com |

Monitoring and Prevention

After taking immediate steps to secure your Apple Watch and contact relevant authorities, it’s crucial to actively monitor your credit card accounts for any suspicious activity. This proactive approach can help you identify and address any potential fraudulent transactions promptly.

Monitoring Credit Card Accounts

To ensure the security of your financial information, it’s vital to diligently monitor your credit card accounts for any unusual or unauthorized activity. This includes regularly checking your account statements, both online and through paper statements, for any transactions you don’t recognize.

- Set Up Account Alerts:Most credit card companies offer email or text message alerts for various account activities, such as transactions exceeding a certain amount, international purchases, or unusual spending patterns. These alerts can provide real-time notifications, enabling you to quickly identify and investigate suspicious activity.

- Review Statements Regularly:Regularly reviewing your credit card statements, both online and paper copies, is essential. Look for any transactions you don’t recognize, especially for purchases made at unfamiliar locations or for amounts that seem out of the ordinary.

- Use Online Banking Tools:Many banks offer online banking tools that allow you to track your account activity, set spending limits, and receive alerts for suspicious transactions. These tools can provide a comprehensive overview of your financial activity and help you identify potential fraud.

Preventing Future Credit Card Theft

While it’s impossible to completely eliminate the risk of credit card theft, implementing preventative measures can significantly reduce your vulnerability.

- Use Strong Passwords:When setting up your Apple Watch or any other device, use strong passwords that are unique to each account. A strong password is at least 12 characters long and includes a mix of uppercase and lowercase letters, numbers, and symbols.

- Enable Two-Factor Authentication:Two-factor authentication adds an extra layer of security by requiring you to enter a code sent to your phone in addition to your password. This makes it much harder for unauthorized individuals to access your accounts.

- Keep Software Updated:Regularly updating the software on your Apple Watch and other devices is crucial for security. Updates often include patches that address vulnerabilities that could be exploited by hackers.

- Be Cautious of Public Wi-Fi:Avoid using public Wi-Fi networks for sensitive transactions, such as online banking or credit card purchases. Public Wi-Fi networks are often less secure and can be susceptible to hacking.

- Protect Your Devices:Secure your Apple Watch and other devices with a strong passcode and consider using a screen lock feature. This will prevent unauthorized access to your device if it’s lost or stolen.

Protecting Personal and Financial Information

Protecting your personal and financial information is essential to prevent identity theft and financial fraud.

- Limit Information Sharing:Be cautious about sharing personal and financial information online or over the phone. Only provide this information to trusted sources and be wary of phishing scams.

- Monitor Credit Reports:Regularly check your credit report for any suspicious activity or errors. You can obtain a free credit report from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion) once a year.

- Shred Sensitive Documents:Shred any documents containing sensitive information, such as credit card statements, bank statements, and medical records, before discarding them.

- Be Aware of Phishing Scams:Phishing scams are attempts to trick you into revealing personal or financial information. Be wary of emails, phone calls, or text messages that request sensitive information or ask you to click on suspicious links.

Additional Security Measures

Beyond the immediate steps to protect your Apple Watch after theft, there are additional security measures you can implement to prevent such situations and safeguard your data.

Strong Passcode and Two-Factor Authentication

A strong passcode is a critical first line of defense against unauthorized access. A strong passcode is at least 6 characters long and includes a combination of uppercase and lowercase letters, numbers, and symbols. Two-factor authentication adds an extra layer of security by requiring a second form of verification, usually a code sent to your phone, in addition to your passcode.

This makes it much harder for someone to access your Apple Watch, even if they know your passcode.

Location Tracking and Remote Wiping

Apple Watch’s “Find My” feature allows you to locate your watch on a map, even if it’s lost or stolen. This feature can be invaluable for recovering your watch or even deterring theft if the thief knows you can track its location.

Remote wiping allows you to erase all data from your Apple Watch remotely, ensuring that your personal information remains secure even if the watch is stolen.

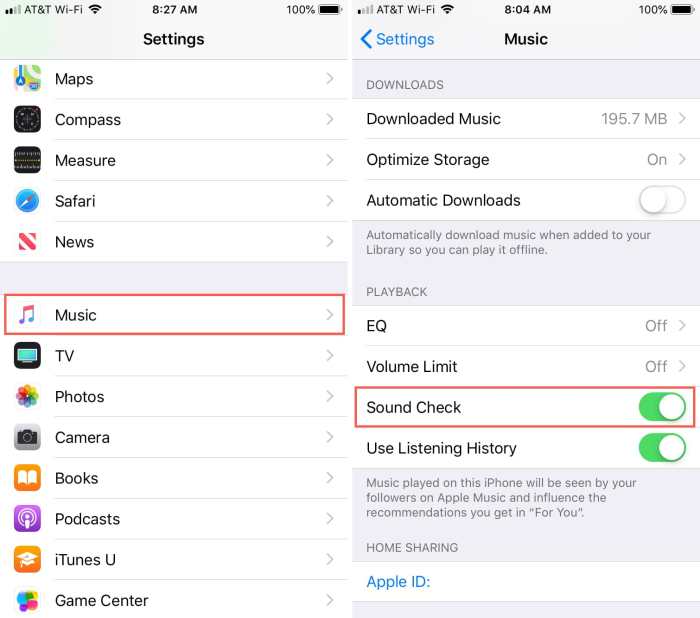

If your Apple Watch gets swiped, you’ll want to report it to Apple and cancel any linked credit cards ASAP. While you’re at it, you can also check out Force Apple Music to play all songs at the same volume with Sound Check , which can help you avoid volume jumps when listening to your tunes.

Getting your watch back is the main priority, but having a consistent listening experience is a nice bonus.

Additional Security Measures

- Disable Automatic Wrist Detection:This feature allows your Apple Watch to unlock automatically when you wear it. Disabling it requires you to enter your passcode each time you put on your watch, adding another layer of security.

- Enable “Lock Apple Watch” Feature:This feature locks your Apple Watch with a passcode after a short period of inactivity.

- Regularly Update Software:Software updates often include security patches that address vulnerabilities. Regularly updating your Apple Watch’s software helps ensure you’re protected against the latest threats.

- Use a Strong Apple ID Password:Your Apple ID password is used to access all of your Apple devices, including your Apple Watch. Using a strong password for your Apple ID helps protect all of your devices.

- Be Cautious When Connecting to Public Wi-Fi:Public Wi-Fi networks can be insecure, making it easier for hackers to steal your personal information. Avoid using public Wi-Fi to access sensitive information on your Apple Watch.

- Enable “Find My” for All Devices:“Find My” can be used to locate any of your Apple devices, including your iPhone, iPad, and Mac. Enabling this feature for all of your devices makes it easier to track them down if they’re lost or stolen.

Legal Considerations

Credit card theft is a serious crime with significant legal implications for both the victim and the perpetrator. Understanding the legal framework surrounding this issue is crucial for protecting yourself and knowing your rights.

Law Enforcement and Investigations

Law enforcement plays a critical role in investigating credit card theft cases. When you report a stolen credit card, law enforcement agencies will initiate an investigation to identify the perpetrator and recover any stolen funds. The investigation may involve tracing the fraudulent transactions, reviewing security footage, and interviewing potential witnesses.

Consumer Protection Laws and Rights

Several federal and state laws protect consumers from credit card fraud. The Fair Credit Billing Act (FCBA) protects consumers from unauthorized charges on their credit cards. Under the FCBA, you are only liable for up to $50 in unauthorized charges if you report the theft promptly.

The Electronic Funds Transfer Act (EFTA) provides similar protections for debit cards and other electronic payment methods.

“The FCBA is a powerful tool for consumers, as it limits your liability for unauthorized charges and provides a process for disputing fraudulent transactions.”

Legal Consequences for Perpetrators

Credit card theft is a federal crime that carries significant penalties. Depending on the severity of the offense and the perpetrator’s criminal history, they may face fines, imprisonment, or both. The penalties can be even more severe if the perpetrator is part of an organized crime ring or if the amount of stolen funds is substantial.

If your Apple Watch gets swiped, you’ll want to clear your credit card info ASAP. But don’t forget to check out How to avoid losing Fortnite when updating to iOS 14 because, let’s be real, losing your game progress is almost as bad as losing your watch! Once you’ve taken care of your Fortnite woes, you can focus on getting your Apple Watch info secured.

“The penalties for credit card theft can be quite severe, with potential fines and prison sentences depending on the circumstances of the case.”

Cybersecurity Awareness

Staying informed about cybersecurity threats and best practices is crucial for protecting yourself and your data. With the increasing prevalence of online scams and data breaches, it’s more important than ever to be vigilant and proactive in securing your digital life.

Phishing Scams

Phishing scams are a common way for cybercriminals to steal personal information, including credit card details. These scams often involve emails or text messages that appear to be from legitimate sources, such as banks or credit card companies. They may ask you to click on a link or provide personal information, such as your username, password, or credit card details.

Here are some tips for avoiding phishing scams:

- Be cautious about clicking on links in emails or text messages, especially if they come from unknown sources.

- Hover your mouse over links before clicking to see where they actually lead.

- Be wary of emails or messages that ask for personal information, especially if they are urgent or threatening.

- If you are unsure about an email or message, contact the company directly through their official website or phone number.

Online Security Best Practices

In addition to being aware of phishing scams, it’s essential to practice good online security habits:

- Use strong passwords that are at least 12 characters long and include a combination of uppercase and lowercase letters, numbers, and symbols.

- Enable two-factor authentication (2FA) whenever possible.

- Keep your software and operating system up to date.

- Be careful about what information you share online, especially on social media.

- Use a reputable antivirus and anti-malware program.

Resources for Learning More

Several resources can help you learn more about online security and data protection:

- The National Cyber Security Alliance (NCSA): The NCSA offers a wealth of information on cybersecurity, including tips for staying safe online, resources for parents and educators, and information on current cybersecurity threats.

- The Federal Trade Commission (FTC): The FTC provides information on consumer protection, including guidance on protecting yourself from online scams and identity theft.

- The U.S. Department of Homeland Security (DHS): The DHS offers resources on cybersecurity, including information on how to protect your home network and devices.

Outcome Summary

Losing your Apple Watch can be a stressful experience, but taking swift action can help minimize the damage. By reporting the theft to authorities, disabling Apple Pay, and contacting your credit card company, you can protect your financial information and regain control.

Remember, staying vigilant about cybersecurity threats and implementing strong security measures is essential to safeguard your personal and financial data. Be proactive and secure your devices, so you can enjoy the convenience of Apple Pay without worry.

Questions Often Asked: How To Clear Credit Card Info From A Stolen Apple Watch

What if I don’t remember my Apple Watch passcode?

If you’ve forgotten your passcode, you’ll need to erase your Apple Watch. This will remove all data, including credit card information. You can erase your Apple Watch remotely using Find My iPhone or by contacting Apple Support.

Can I recover my credit card information from a stolen Apple Watch?

No, your credit card information isn’t stored on your Apple Watch. Apple Pay uses a token system, so the actual card details are not accessible. However, you should still report the theft to your credit card company to prevent unauthorized charges.

What if the thief already made purchases with my Apple Watch?

If you suspect unauthorized charges, immediately contact your credit card company and report the fraudulent activity. They will investigate the charges and help you resolve the issue.