How To Clean Your Apple Card. Seriously.

How to clean your Apple Card. Seriously. You might be thinking, “Wait, my Apple Card is digital, how do I clean it?” Well, while you can’t exactly scrub it with soap and water, keeping your Apple Card clean is all about digital hygiene and security.

Think of it like this: your Apple Card is a gateway to your finances, and just like you wouldn’t leave your wallet open on a park bench, you need to protect it from digital threats.

This guide will walk you through the essential steps to keep your Apple Card safe and secure, from understanding its features to protecting your data and preventing fraud. We’ll cover everything from setting strong passwords to being aware of phishing scams, so you can confidently use your Apple Card without worrying about any digital dirt.

Understanding the Apple Card

The Apple Card is a credit card offered by Apple in partnership with Goldman Sachs. It’s a digital-first card, designed to seamlessly integrate with Apple Pay and the Apple ecosystem. This means you can use it to make purchases in stores and online with your iPhone, Apple Watch, or Mac.

The Apple Card also offers a range of features and benefits that make it a compelling option for consumers.

Benefits of the Apple Card

The Apple Card offers a number of advantages, including:

- Daily Cash Rewards:You earn 3% cash back on Apple purchases, 2% cash back at restaurants and gas stations, and 1% cash back on all other purchases. This cash back is automatically deposited into your Apple Cash account, which can be used to make purchases or transfer to a bank account.

- No Annual Fee:The Apple Card has no annual fee, making it a more affordable option compared to many traditional credit cards.

- Credit Building:Using the Apple Card responsibly can help you build a good credit score, which is important for accessing loans, mortgages, and other financial products.

- Transparency and Simplicity:The Apple Card app provides a clear and concise overview of your spending, making it easy to track your finances. The app also offers helpful features like spending categories and personalized recommendations.

Digital Hygiene and Security

Since the Apple Card is a digital card, it’s crucial to prioritize digital hygiene and security to protect your information. Here are some key considerations:

- Keep Your Devices Secure:Ensure your iPhone, Apple Watch, and Mac are protected with strong passwords and up-to-date software. This helps prevent unauthorized access to your Apple Card information.

- Enable Two-Factor Authentication:Two-factor authentication adds an extra layer of security by requiring a code from your phone or email when logging into your Apple Card account.

- Be Aware of Phishing Scams:Phishing scams are designed to trick you into revealing your personal information. Be cautious of suspicious emails, text messages, or websites that request your Apple Card details.

- Report Lost or Stolen Devices:If your iPhone, Apple Watch, or Mac is lost or stolen, immediately report it to Apple and contact Apple Card support to disable your card.

Maintaining Digital Security: How To Clean Your Apple Card. Seriously.

Your Apple Card is a valuable tool for managing your finances, and it’s important to keep your account secure. Protecting your Apple Card account is crucial for preventing unauthorized access and protecting your financial information. Here’s how you can take steps to safeguard your account.

Okay, so you’re wondering how to clean your Apple Card, right? No worries, it’s super easy. Just use a soft cloth and a little bit of rubbing alcohol. And while we’re on the topic of cleaning up, check out this Pro Tip: How to pick a new thumbnail for your Live Photos.

You can make your Live Photos look way better by picking a more flattering frame. Anyways, back to the Apple Card. Make sure you don’t scratch the surface with any rough materials, and you’re good to go.

Strong Passwords and Multi-Factor Authentication

A strong password is essential for securing your Apple Card account. It should be at least 12 characters long, including a combination of uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessed information like your birthdate or pet’s name.Multi-factor authentication (MFA) adds an extra layer of security to your account.

When you enable MFA, you’ll need to enter a unique code sent to your phone or email in addition to your password when logging in. MFA significantly reduces the risk of unauthorized access, even if someone obtains your password.

Managing and Monitoring Your Apple Card Activity

Regularly monitoring your Apple Card activity is crucial for identifying any suspicious transactions. You can review your transaction history within the Apple Wallet app or on the Apple Card website. You can also set spending limits to control how much you can spend on your card each day, week, or month.

Keeping Your Software and Devices Updated, How to clean your Apple Card. Seriously.

Software updates often include security patches that address vulnerabilities in your device’s operating system and apps. Updating your iPhone, iPad, and Mac regularly ensures your Apple Card account is protected from the latest threats. It’s also important to keep your Apple Card app updated to ensure you have the latest security features.

Preventing Fraud and Unauthorized Access

While Apple Card offers robust security features, it’s essential to be aware of potential threats and take proactive steps to safeguard your account. This section delves into common fraud scenarios and provides guidance on how to protect yourself.

Understanding Common Fraud Types

Fraudulent activities targeting Apple Card users can take various forms.

- Unauthorized Purchases:This involves someone making transactions on your card without your permission, potentially using stolen card details or compromised accounts.

- Account Takeover:This occurs when a fraudster gains control of your Apple Card account, enabling them to change account settings, make purchases, or even withdraw funds.

Steps to Take in Case of Suspected Fraud

If you suspect any fraudulent activity on your Apple Card, it’s crucial to act swiftly.

- Contact Apple Support:Reach out to Apple’s customer service immediately to report the suspicious activity. They can guide you through the necessary steps and initiate an investigation.

- Report Suspicious Activity:File a fraud report with your local law enforcement agency. This helps in documenting the incident and potentially aiding in the investigation.

- Review Your Account:Carefully check your recent transactions and statements for any unauthorized charges.

- Change Your Password:If you suspect your account has been compromised, immediately change your Apple ID password and any other passwords associated with your Apple Card account.

- Contact Your Bank:Inform your bank about the suspected fraud. They may be able to freeze your card or initiate a chargeback process.

Apple’s Fraud Detection Systems

Apple employs sophisticated fraud detection systems to proactively identify and prevent unauthorized activity. These systems analyze transaction patterns, user behavior, and other data points to flag suspicious activities in real time.

“Apple’s fraud detection systems use advanced algorithms to analyze millions of data points, identifying potential threats and preventing unauthorized transactions.”

These systems are constantly evolving to stay ahead of emerging fraud techniques, providing an extra layer of protection for Apple Card users.

Keeping Your Data Secure

Your Apple Card data is as valuable as your physical wallet, so keeping it safe is paramount. Apple takes data privacy seriously, implementing robust security measures to protect your information.

Protecting Your Data

Here are some tips to keep your personal information safe while using your Apple Card:

- Avoid Public Wi-Fi:Public Wi-Fi networks can be vulnerable to security breaches. Use a VPN or stick to secure private networks when making transactions or accessing your Apple Card account.

- Beware of Phishing Attempts:Be cautious of suspicious emails or text messages requesting personal information. Apple will never ask for your card details or security codes via email or text.

- Use Strong Passwords:Choose unique, complex passwords for your Apple ID and Apple Card account. Consider using a password manager to securely store and manage your passwords.

- Enable Two-Factor Authentication:This adds an extra layer of security by requiring a code sent to your trusted device before logging in.

- Report Suspicious Activity:If you notice any unauthorized transactions or suspicious activity on your Apple Card account, report it to Apple immediately.

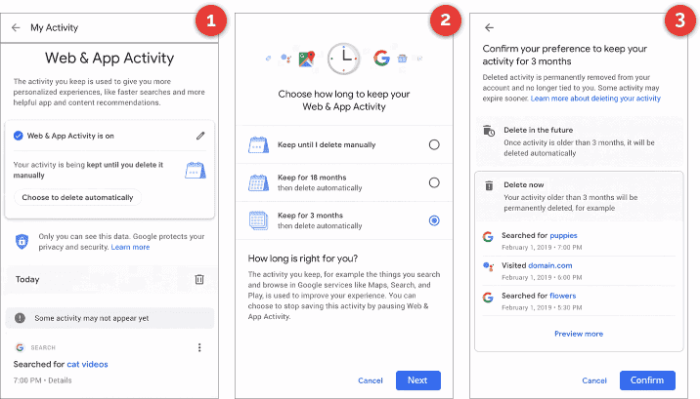

Managing and Deleting Your Data

You can easily manage and delete your Apple Card data through the Wallet app:

- Access Your Apple Card Settings:Open the Wallet app and tap on your Apple Card. Select “More” and then “Settings.”

- Review Your Data:Here, you can view your transaction history, account details, and other information.

- Delete Your Data:You can choose to delete specific transactions or your entire transaction history. Keep in mind that deleting your data may affect certain features or functionalities.

Resolving Issues and Seeking Support

Sometimes, despite our best efforts, issues can arise with your Apple Card. Whether it’s a declined transaction, a forgotten PIN, or a lost card, knowing how to get help is crucial. Apple offers a variety of support channels to address your concerns and get you back on track.

Contacting Apple Support

Apple provides multiple ways to connect with their support team for assistance with your Apple Card. These options offer flexibility and convenience, allowing you to choose the method that best suits your needs.

So, you wanna keep your Apple Card looking fresh? A microfiber cloth and a little rubbing alcohol should do the trick. But, hey, if you’re printing out a receipt for that new pair of shoes you bought with your card, you can use your iPhone! Check out this guide on How to print from your iPhone using AirPrint and make sure that receipt looks super clean too.

Then, you can proudly display your card and your receipt together, no problem.

- Phone Support:You can call Apple Support directly at 1-800-275-2273. This is the fastest way to get immediate assistance, especially for urgent matters. Be prepared to provide your Apple Card details and a brief explanation of your issue.

- Online Chat:For less urgent issues, you can initiate a live chat session with an Apple Support representative through the Apple Card website or the Apple Support app. This allows for real-time communication and a more visual approach to problem-solving.

- Email Support:If your query is not time-sensitive, you can send an email to Apple Support through the Apple Card website. This option provides a written record of your request and allows for detailed explanations of your issue.

Reporting Lost or Stolen Cards

If you’ve lost or had your Apple Card stolen, it’s essential to act quickly to prevent unauthorized use. Apple provides a dedicated process for reporting these incidents:

- Report the loss or theft immediately:Contact Apple Support through one of the methods described above. Be prepared to provide your Apple Card details and the date and time of the loss or theft.

- Cancel your card:Apple will immediately deactivate your card to prevent further transactions. You’ll receive a confirmation of the cancellation.

- Request a replacement card:Apple will issue a new card with a different card number. You can choose to have it mailed to your address or pick it up at an Apple Store.

Troubleshooting Common Issues

Many Apple Card issues can be resolved independently through basic troubleshooting steps. Here are some common scenarios and their potential solutions:

- Declined Transactions:This can occur due to insufficient funds, a frozen account, or an expired card. Check your account balance, ensure your card is active, and confirm the expiration date. If the issue persists, contact Apple Support.

- Payment Errors:If you encounter difficulties making a payment, review your payment information and ensure it’s accurate. Check for any pending transactions that might be affecting your available balance. If the issue continues, reach out to Apple Support.

- Forgotten PIN:If you’ve forgotten your Apple Card PIN, you can reset it through the Apple Wallet app on your iPhone or Apple Watch. Follow the on-screen instructions to create a new PIN.

Maintaining a Positive Credit History

Your Apple Card isn’t just a way to make purchases; it’s also a powerful tool for building a strong credit history. A positive credit history is essential for many aspects of your financial life, from securing loans and mortgages to getting approved for apartment rentals.

The Importance of Responsible Credit Card Usage

Responsible credit card usage is crucial for building a positive credit history. When you use your Apple Card wisely, you demonstrate to lenders that you are a reliable borrower. This can lead to better interest rates on loans, lower insurance premiums, and even more favorable terms on other financial products.

Managing Your Apple Card Balance and Making Timely Payments

Managing your Apple Card balance and making timely payments are key to maintaining a good credit score. Here are some tips:

- Set a budget and stick to it.This will help you avoid overspending and accumulating large balances.

- Pay your bill in full each month, if possible.This will prevent interest charges from accumulating.

- Make payments on time.Late payments can negatively impact your credit score.

- Consider using the Apple Card’s automatic payment feature.This ensures that your bill is paid on time each month.

Understanding How Your Apple Card Activity Impacts Your Credit Score

Your Apple Card activity plays a significant role in shaping your credit score. Here’s how:

- Credit utilization ratio:This measures the amount of credit you are using compared to your total available credit. A lower credit utilization ratio is generally better for your credit score.

- Payment history:On-time payments are essential for maintaining a good credit score. Late payments can significantly lower your score.

- Length of credit history:The longer your credit history, the better. This shows lenders that you have a track record of responsible credit usage.

- New credit:Opening new credit accounts can temporarily lower your credit score.

Benefits of a Good Credit Score

A good credit score can open doors to many financial opportunities. Here are some of the benefits:

- Lower interest rates on loans:A good credit score can qualify you for lower interest rates on mortgages, auto loans, and personal loans.

- Easier approval for credit cards:You’ll have a better chance of being approved for credit cards with higher credit limits and more attractive rewards programs.

- More favorable terms on insurance:A good credit score can lead to lower premiums on auto, home, and renters insurance.

- Improved rental application chances:Landlords often check your credit score when evaluating rental applications.

Closing Your Apple Card Account

If you’ve decided you no longer need your Apple Card, closing the account is a straightforward process. Here’s what you need to know about closing your account and its impact on your credit history.

Closing Your Account

To close your Apple Card account, you’ll need to contact Apple directly. You can do this by calling Apple Support or by using the Apple Wallet app. When you contact Apple, you’ll need to provide your Apple ID and any other information they request to verify your identity.Here are the steps to take to close your Apple Card account:

- Pay off any outstanding balance on your account. This is crucial, as closing an account with an outstanding balance can negatively impact your credit score. You can use the Apple Wallet app or Apple’s website to make payments.

Okay, so you want to clean your Apple Card. Seriously? I mean, it’s a card, right? But hey, if you’re into that kind of thing, maybe you should check out how to use Ableton Live or Logic Pro X on your iPad, like this article here.

It’s pretty cool how you can make music on your iPad, so maybe you can use that to create a song about the importance of cleaning your Apple Card. Who knows, maybe you’ll be the next big music sensation.

But really, just use a microfiber cloth and some rubbing alcohol. It’s not rocket science.

- Contact Apple Support. You can call Apple Support or use the Apple Wallet app to initiate the closure process. You will need to provide your Apple ID and any other information they request to verify your identity.

- Confirm the closure with Apple Support. Make sure to get confirmation from Apple Support that your account has been closed. This helps to avoid any potential issues later on.

Implications on Your Credit History

Closing your Apple Card account can have a few implications for your credit history.

- Your credit utilization ratio will be affected. This is the amount of credit you’re using compared to your total available credit. Closing an account reduces your available credit, which can temporarily increase your credit utilization ratio. However, if you have other credit accounts open, this impact should be minimal.

- Your average account age will be affected. This is the average age of all your credit accounts. Closing an account can lower your average account age, which can slightly impact your credit score.

- Your credit score may be affected. The impact on your credit score will depend on several factors, including your credit history, the length of time you’ve had the account, and your overall credit utilization. In general, closing an account with a good payment history can have a small negative impact on your credit score.

However, if you have a history of late payments or other negative credit history, closing the account may not significantly impact your score.

Alternatives to Closing Your Account

Before you decide to close your Apple Card account, consider some alternatives that may be more beneficial for your credit score.

- Lower Your Credit Limit:Contact Apple and request to lower your credit limit. This will reduce your available credit, which can help to improve your credit utilization ratio. This is a good option if you are concerned about overspending or if you are trying to improve your credit score.

- Set a Spending Limit:You can set a spending limit for your Apple Card in the Apple Wallet app. This can help you to avoid overspending and stay within your budget. This is a good option if you are trying to manage your spending and avoid accruing debt.

- Make Payments on Time:Make sure to make your payments on time every month. This is the most important factor in maintaining a good credit score. You can set up automatic payments to help you avoid missing payments.

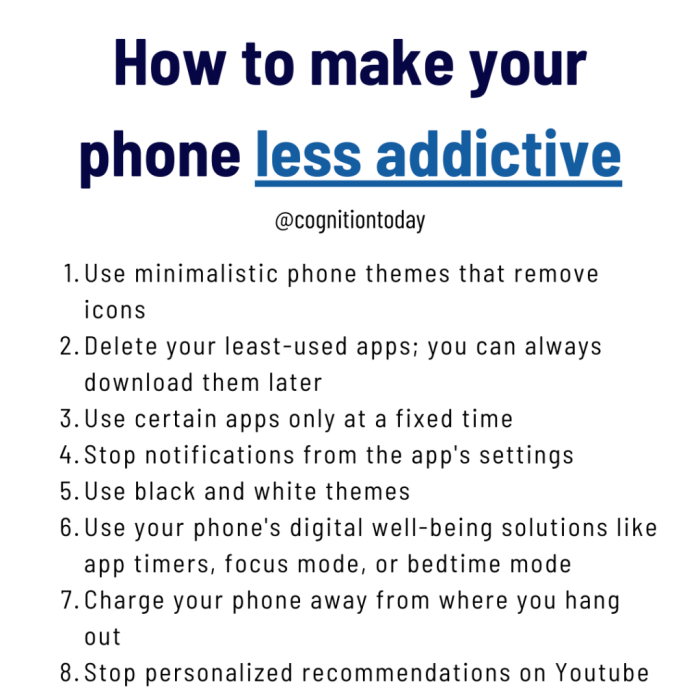

Additional Tips for Digital Hygiene

Protecting your digital life is an ongoing effort, and it extends beyond just your Apple Card. Think of it as a holistic approach to keeping your information safe across all your online accounts.

Digital Hygiene Practices for All Online Accounts

Here are some essential practices to adopt for all your online accounts, not just your Apple Card:

| Practice | Description | Benefits |

|---|---|---|

| Strong Passwords | Use a unique, complex password for each account, combining uppercase and lowercase letters, numbers, and symbols. Avoid common words or personal information. | Reduces the risk of unauthorized access and protects your accounts from hackers. |

| Two-Factor Authentication (2FA) | Enable 2FA, which requires an additional code sent to your phone or email, in addition to your password, to log in. | Adds an extra layer of security and makes it significantly harder for attackers to gain access to your accounts. |

| Regularly Review Account Activity | Check your account statements, transactions, and email notifications for any suspicious activity. Report any unusual or unauthorized transactions immediately. | Helps you detect and prevent fraudulent activity early on, minimizing potential damage. |

| Be Cautious of Phishing Attempts | Be wary of emails, texts, or calls that ask for personal information or try to direct you to suspicious websites. Legitimate companies will never ask for your password or sensitive information via email. | Protects you from scams that aim to steal your login credentials and other personal information. |

| Keep Software Updated | Install the latest software updates for your operating system, web browser, and other applications. Updates often include security patches that fix vulnerabilities. | Minimizes the risk of exploitation by attackers who target known security weaknesses in outdated software. |

| Use a Password Manager | Consider using a password manager to securely store and manage your passwords, making it easier to create strong and unique passwords for all your accounts. | Improves password security and reduces the risk of forgetting or losing passwords. |

| Be Mindful of Public Wi-Fi | Avoid accessing sensitive accounts or conducting financial transactions on public Wi-Fi networks. If you must use public Wi-Fi, consider using a VPN to encrypt your traffic. | Protects your data from potential eavesdroppers who might be monitoring public Wi-Fi networks. |

Protecting Your Devices

Your Apple devices are more than just tools; they hold your personal information, financial data, and access to your digital life. Keeping them secure is crucial to protecting yourself from potential threats. Think of it as a digital fortress for your data, and we’re about to learn how to make it impenetrable.

Device Security Features

Enabling security features is like adding extra locks to your digital fortress. Here’s how to make your devices more secure:

- Passcodes:A passcode acts as the first line of defense against unauthorized access. Set a strong, unique passcode that’s difficult to guess. Avoid using common patterns or birthdates.

- Face ID/Touch ID:These biometric authentication methods provide an extra layer of security. They use your unique facial features or fingerprint to verify your identity. Make sure to enroll your face or fingerprint correctly for accurate recognition.

- Find My:This feature allows you to locate your lost or stolen devices, remotely lock them, or even erase their data. Make sure to enable Find My on all your devices and keep your location services turned on.

Protecting Against Malware and Threats

Malware, like viruses, can harm your devices and steal your data. Here’s how to protect yourself:

- Keep Software Up-to-Date:Software updates often include security patches that fix vulnerabilities and protect against known threats. Make sure to install updates as soon as they become available.

- Use Reputable Apps:Download apps only from the App Store. Avoid downloading apps from unknown sources, as they could contain malware.

- Be Cautious of Phishing Attacks:Phishing emails or messages try to trick you into giving away personal information. Be wary of suspicious links or requests for sensitive data.

- Use Antivirus Software:While Apple devices are generally considered secure, using antivirus software can provide an extra layer of protection. There are several reputable antivirus apps available in the App Store.

Staying Informed About Security Threats

The digital landscape is constantly evolving, and so are the threats that target your online security. Staying informed about emerging threats is crucial for protecting your Apple Card and other digital assets. By understanding the latest tactics used by cybercriminals, you can take proactive steps to mitigate risks and safeguard your data.

Resources for Staying Informed

Staying up-to-date on security threats is essential for maintaining a secure digital environment. There are various resources available to help you stay informed:

- Security Blogs and Websites:Websites like Krebs on Security, Threatpost, and Bleeping Computer provide regular updates on emerging threats, data breaches, and security vulnerabilities. These resources often feature in-depth analysis and technical details, offering valuable insights for tech-savvy users.

- Security Newsletters and Alerts:Subscribe to security newsletters from reputable organizations like the National Institute of Standards and Technology (NIST), the Cybersecurity and Infrastructure Security Agency (CISA), and your bank or credit card issuer. These newsletters often contain alerts about specific threats, best practices for protection, and information about security updates.

- Social Media:Follow security experts and organizations on social media platforms like Twitter and LinkedIn. They often share insights, tips, and warnings about emerging threats. Be cautious about information from unverified sources.

- Security Forums and Communities:Participate in online forums and communities dedicated to cybersecurity. Engage in discussions with other users and learn from their experiences. Remember to be respectful and avoid sharing sensitive information in public forums.

Reviewing and Updating Security Settings

Regularly reviewing and updating your Apple Card security settings is crucial for protecting your financial information and preventing unauthorized access. These settings act as a strong line of defense against potential threats, ensuring your card and personal data remain safe.

Accessing and Managing Security Settings

You can easily access and manage your Apple Card security settings within the Apple Wallet app. This app provides a centralized hub for managing your card’s security features and keeping your financial information secure.

- Open the Apple Wallet app:Launch the app on your iPhone or iPad.

- Select your Apple Card:Tap on the Apple Card that you want to manage.

- Access the settings:Tap on the three dots (•••) in the upper right corner of the screen.

- Navigate to security settings:From the menu, choose “Security” to view and modify your security settings.

Enabling Security Features

Once you’ve accessed the security settings, explore and enable various features that enhance your Apple Card’s protection.

- Location Services:Enabling location services allows your Apple Card to detect unusual activity based on your location. For example, if your card is used in a location significantly different from your usual spending patterns, you’ll receive a notification.

- Transaction Notifications:Activating transaction notifications sends you real-time alerts whenever your Apple Card is used. This helps you monitor your spending and quickly identify any unauthorized transactions.

- Face ID or Touch ID:Utilizing Face ID or Touch ID adds an extra layer of security by requiring biometric authentication before making any purchases with your Apple Card.

- Device Lock:Ensuring your iPhone or iPad is locked with a passcode or biometric authentication prevents unauthorized access to your Apple Wallet and Apple Card.

Final Conclusion

Keeping your Apple Card clean isn’t just about avoiding physical grime, it’s about creating a strong digital fortress to protect your financial information. By following the tips in this guide, you can navigate the digital world with confidence, knowing your Apple Card and your financial well-being are secure.

Remember, it’s not about being paranoid, it’s about being proactive and taking the necessary steps to protect yourself from potential threats. So, let’s get started and keep your Apple Card shining clean!

FAQs

What are some common ways to protect my Apple Card from unauthorized access?

Using a strong password, enabling two-factor authentication, and being cautious about phishing attempts are all important steps in protecting your Apple Card from unauthorized access.

What should I do if I suspect my Apple Card has been compromised?

If you suspect your Apple Card has been compromised, immediately contact Apple Support and report any suspicious activity. You should also change your Apple ID password and enable two-factor authentication.

How do I know if my Apple Card is linked to a specific device?

You can check which devices are linked to your Apple Card by going to the Apple Wallet app and looking at the “Cards” section. You can also manage and remove devices from your Apple Card settings.