5 Free Notion Budget Templates to Help You Manage Your Money

5 Free Notion Budget Templates to Track Your Expenses and Savings – Looking to get your finances in order? Notion’s got you covered with these five free budget templates. Whether you’re a budgeting newbie or a seasoned pro, there’s a template here for you. Read on to learn more about each template and how it can help you track your expenses, save money, and reach your financial goals.

Notion is a powerful project management tool that can be used for a variety of purposes, including budgeting. It’s easy to use, customizable, and can be accessed from anywhere with an internet connection. This makes it a great option for people who want to track their finances on the go.

Introduction to Notion and Budgeting

Notion is a project management tool that offers a wide range of features to help you organize your projects, track your progress, and collaborate with others. It’s a great tool for budgeting because it allows you to create custom templates, track your expenses and income, and generate reports.

Benefits of Using Notion for Budgeting

There are many benefits to using Notion for budgeting, including:

- Flexibility:Notion allows you to create custom templates that fit your specific needs.

- Tracking:You can easily track your expenses and income in Notion.

- Reporting:Notion can generate reports that show you how you’re spending your money.

- Collaboration:You can collaborate with others on your budget in Notion.

Overview of the 5 Free Notion Budget Templates

Notion, a versatile productivity platform, offers a range of budget templates to help you manage your finances effectively. These templates provide customizable and user-friendly tools to track expenses, set savings goals, and gain insights into your financial habits.

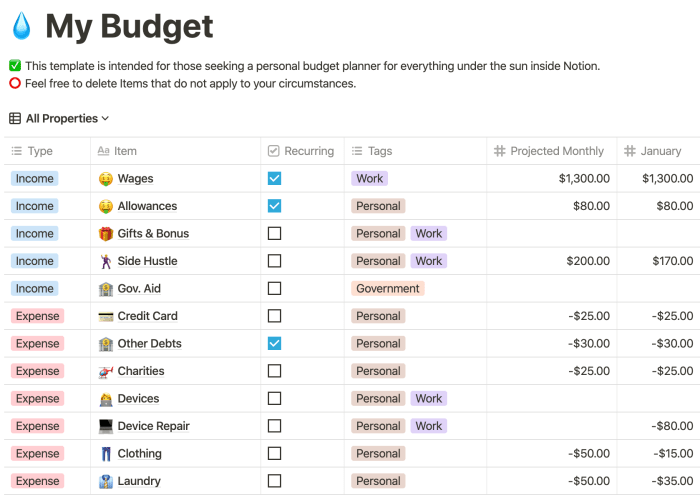

1. Basic Budget Template, 5 Free Notion Budget Templates to Track Your Expenses and Savings

- Simple and straightforward template for beginners.

- Allows you to track income and expenses in one central location.

- Provides an overview of your financial situation.

2. Zero-Based Budget Template

- Ensures that every dollar is accounted for.

- Assigns each dollar to a specific category, including savings.

- Helps you avoid overspending and promotes financial discipline.

3. 50/30/20 Budget Template

- Popular budgeting method that allocates 50% of income to needs, 30% to wants, and 20% to savings.

- Provides a balanced approach to budgeting.

- Helps you prioritize essential expenses and build a savings cushion.

4. Envelope Budget Template

- Simulates the traditional envelope budgeting method.

- Assigns specific amounts of cash to different categories.

- Encourages mindful spending and helps you stay within your budget.

5. Advanced Budget Template

- Comprehensive template for advanced budgeting.

- Includes features such as debt tracking, investment tracking, and financial forecasting.

- Suitable for individuals with complex financial situations or those looking for a more detailed approach to budgeting.

Template 1: Basic Budget Tracker

This template is a simple and straightforward way to track your income and expenses. It’s perfect for those who are just starting out with budgeting or who want a no-frills option.

The template includes a table with columns for the date, description, amount, and category. You can customize the categories to fit your needs, and you can also add notes to each transaction.

The template also includes a summary section that shows your total income and expenses for the month, as well as your net income. This information can be helpful for seeing where your money is going and for making adjustments to your budget as needed.

Reporting Options

The template includes several reporting options to help you visualize your spending and make informed decisions about your finances.

- Income and Expense Summary:This report shows a breakdown of your income and expenses by category.

- Cash Flow Statement:This report shows your cash inflows and outflows for the month.

- Balance Sheet:This report shows your assets, liabilities, and net worth at the end of the month.

Template 2: Zero-Based Budget

Zero-based budgeting is a budgeting method where you allocate every dollar of your income to specific categories. This approach ensures that every dollar has a purpose and that you’re not overspending in any area.

To use the Zero-Based Budget template, start by entering your income and expenses. Then, allocate your income to different categories, such as rent, groceries, entertainment, and savings. Make sure to account for every dollar, including small expenses like coffee or snacks.

Allocating Funds Effectively

- Prioritize needs over wants:Allocate funds to essential expenses first, such as housing, food, and transportation. Then, allocate funds to non-essential expenses, such as entertainment and dining out.

- Set realistic goals:Don’t allocate more money to a category than you can realistically afford. Start with a conservative budget and adjust it as needed.

- Be flexible:Life happens, and sometimes you may need to adjust your budget. Be willing to move funds between categories as needed, but make sure to stay within your overall income.

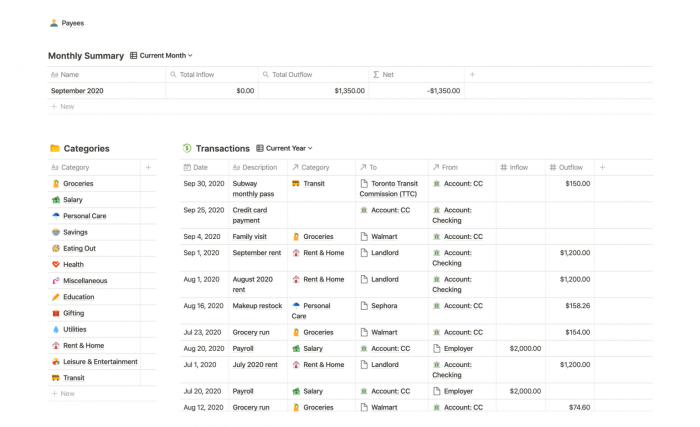

Template 3: Envelope Budgeting: 5 Free Notion Budget Templates To Track Your Expenses And Savings

Envelope budgeting is a traditional budgeting method that involves dividing your money into different categories, each represented by an envelope. The advantage of this method is its simplicity and its ability to help you stay within your budget by physically seeing how much money you have left in each category.

To implement envelope budgeting using this template, follow these steps:

Creating Categories

- Identify the categories you need to budget for, such as groceries, entertainment, and transportation.

- Create a separate row for each category in the template.

- Assign a budget amount to each category.

Tracking Expenses

- Enter your expenses in the appropriate category rows.

- As you spend money, physically remove the corresponding amount from the envelope.

- When the envelope is empty, you know you’ve reached your budget for that category.

Benefits

- Simple and easy to understand.

- Helps you stay within your budget by limiting your spending to the amount of cash you have in each envelope.

- Provides a physical representation of your budget, making it easier to track your progress.

Template 4: Savings Tracker

The Savings Tracker template helps you set specific savings goals, track your progress, and adjust your strategies as needed.

With this template, you can:

Set Savings Goals

- Define specific savings goals, including the amount you want to save and the target date.

- Track your progress towards each goal and see how much you’ve saved so far.

Monitor Progress

- View a visual representation of your savings progress over time.

- Identify areas where you’re meeting or exceeding your goals and where you may need to adjust.

Adjust Strategies

- Analyze your spending habits and identify areas where you can cut back or save more.

- Adjust your savings strategies to maximize your progress and reach your goals faster.

Template 5: Debt Repayment Plan

Manage your debts effectively with this comprehensive debt repayment template. It streamlines the process of creating a customized plan, empowering you to tackle your financial obligations and achieve financial freedom.

The template supports multiple debt repayment strategies, including the debt avalanche method and the debt snowball method. It provides a step-by-step guide to help you:

Creating a Debt Repayment Plan

- List your debts, including the balance, interest rate, and minimum payment for each.

- Choose a debt repayment strategy (debt avalanche or debt snowball).

- Allocate extra funds towards the debt you want to pay off first.

- Make additional payments towards the principal balance whenever possible.

- Track your progress and adjust your plan as needed.

Customizing and Using the Templates

These Notion budget templates are highly customizable to fit your unique needs. You can easily change the categories, add or remove sections, and adjust the colors and fonts to match your preferences.

To effectively use these templates, make sure to regularly update your expenses and income. Categorize your transactions to track where your money is going and identify areas where you can save. Set realistic budgeting goals and review your progress regularly to stay on track.

Customizing the Templates

- Duplicate the template into your Notion workspace.

- Rename the template and sections to match your preferences.

- Add or remove categories to fit your spending habits.

- Customize the colors, fonts, and layout to make it visually appealing and easy to use.

Tips for Effective Budgeting

- Be consistent with updating your expenses and income.

- Categorize your transactions to track spending patterns.

- Set realistic budgeting goals and stick to them.

- Review your progress regularly and make adjustments as needed.

- Use the templates as a tool to gain insights into your financial habits and make informed decisions.

Benefits of Using Notion Budget Templates

Harnessing the power of Notion budget templates offers a plethora of benefits that can revolutionize your financial management. Let’s dive into how these templates can elevate your budgeting game:

Enhanced Financial Visibility:Notion templates provide a comprehensive snapshot of your financial landscape, allowing you to track income, expenses, savings, and debt in one centralized location. This crystal-clear view empowers you to make informed decisions and identify areas for improvement.

Accountability and Control:Using Notion budget templates fosters a sense of accountability, as you are constantly monitoring your financial transactions. This awareness promotes responsible spending habits and prevents unnecessary expenses from slipping through the cracks.

Success Stories

Countless individuals have reaped the rewards of using Notion budget templates. Here’s a compelling case study:

Sarah, a freelance writer, struggled to manage her fluctuating income. By implementing a Notion budget template, she gained clarity over her cash flow and identified areas where she could optimize her spending. As a result, she reduced her unnecessary expenses by 25%, allowing her to save more and achieve her financial goals.

Final Summary

These five Notion budget templates are a great way to get started with budgeting or to improve your current budgeting system. They’re easy to use, customizable, and can help you track your expenses, save money, and reach your financial goals.

So what are you waiting for? Download your free templates today and start taking control of your finances!

Questions and Answers

What is Notion?

Notion is a project management tool that can be used for a variety of purposes, including budgeting. It’s easy to use, customizable, and can be accessed from anywhere with an internet connection.

How do I use the Notion budget templates?

The Notion budget templates are easy to use. Simply download the template that you want to use and open it in Notion. Then, follow the instructions in the template to start tracking your expenses and income.

Can I customize the Notion budget templates?

Yes, you can customize the Notion budget templates to fit your needs. You can change the categories, add or remove sections, and change the design of the template.